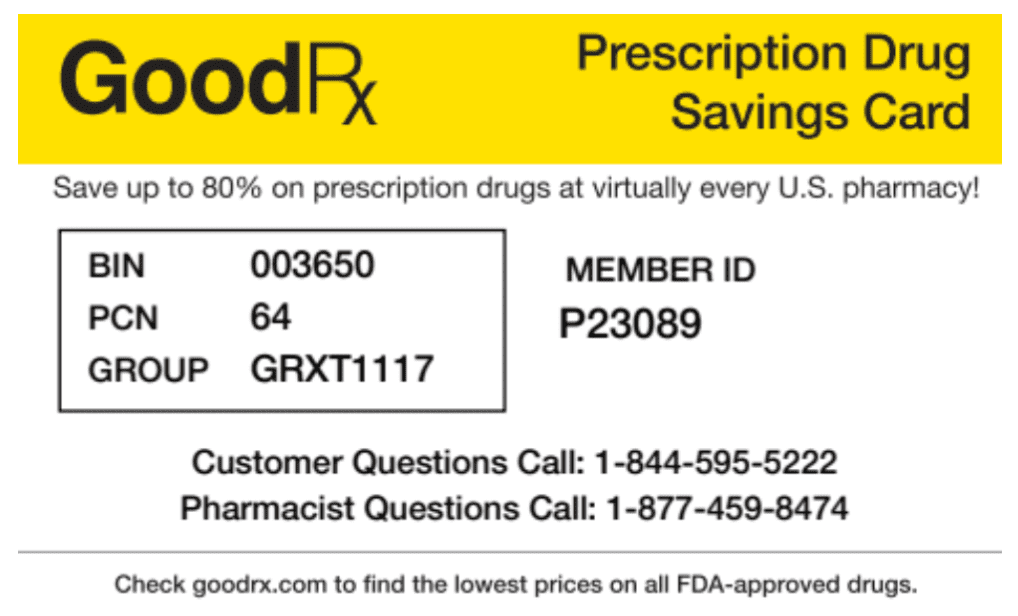

Feeling overwhelmed by prescription costs? Many discount plans offer substantial savings – often 70-80% – on brand-name and generic medications. Consider GoodRx or SingleCare; these popular options provide readily accessible online tools and physical cards for immediate discounts at participating pharmacies.

Don’t rely solely on one plan. Compare pricing across several services, including those offered by your insurance provider. Many plans have different discounts for different drugs, so check prices for *your* specific prescriptions before committing. This quick comparison could save you hundreds of dollars annually.

Remember to verify your pharmacy’s participation. Not all pharmacies accept every discount plan. Confirm eligibility before your visit to avoid disappointment. Also, check whether you can use a plan with your existing insurance–often you can use either the insurance or the discount plan for a lower price, not one or the other.

Pro-tip: Explore manufacturer coupons and patient assistance programs. These options, available for many medications, provide additional cost reductions or even free medication. These resources often complement discount plans, creating a multi-pronged savings strategy.

- Cheap Prescription Drug Discount Plans: A Comprehensive Guide

- How to Find and Choose the Best Prescription Discount Plan for Your Needs

- Check for Pharmacy Network Coverage

- Scrutinize the Fine Print

- Read Reviews

- Consider Your Medication Needs

- Compare Total Cost

- Maximizing Savings with Your Prescription Drug Discount Plan

- Generic Medications

- Prescription Drug Savings Programs

- 90-Day Supplies

- Negotiate Prices

- Check for Hidden Fees

- Regularly Review Your Plan

Cheap Prescription Drug Discount Plans: A Comprehensive Guide

Start by comparing plans from different providers. Many reputable companies offer discounts, and their savings vary widely based on the medication and pharmacy. Check their websites directly for specific drug pricing.

Consider your medication needs. Some plans offer better discounts on certain types of drugs. If you have several prescriptions, prioritize those with higher costs when evaluating plan benefits.

Read the fine print. Pay close attention to any restrictions or exclusions. Some plans have limitations on the number of prescriptions or types of pharmacies they cover. Understand the full scope of the plan before signing up.

Explore options beyond single-plan discounts. Look into manufacturer coupons or patient assistance programs. These can often be combined with discount plans for maximum savings. Pharmacy-specific reward programs might also provide additional cost reductions.

Verify pharmacy participation. Before enrolling, confirm that your preferred pharmacy accepts the plan. Not all pharmacies are partnered with every discount program.

Don’t hesitate to contact the provider. If you have questions about a specific drug or the plan’s terms, speak directly with a customer service representative. Many providers offer support via phone or online chat.

Track your savings. After several months, review your prescription costs to gauge the actual value of your discount plan. This helps in making informed decisions about renewal or switching plans in the future.

Remember, drug pricing can fluctuate. Regularly check your plan’s pricing and explore alternative options to ensure you’re consistently getting the best deals on your prescriptions. Compare multiple plans annually to adapt to changing market conditions.

Good luck finding the right plan for your needs!

How to Find and Choose the Best Prescription Discount Plan for Your Needs

Begin by comparing plans using a reputable comparison website. These sites allow you to input your medications and see discounts offered by various plans. Pay close attention to the specific medications you need, not just broad categories.

Check for Pharmacy Network Coverage

Verify which pharmacies participate in your chosen plan’s network. A wider network means more convenient access to discounted prescriptions. Consider the location of participating pharmacies relative to your home and work.

Scrutinize the Fine Print

Carefully read the plan’s terms and conditions. Understand any limitations, such as restrictions on refills or specific medication exclusions. Note any enrollment fees or annual membership costs. Compare these costs to expected savings.

Read Reviews

Check online reviews from other users. Look for feedback on the ease of using the plan, the speed of processing claims, and customer service responsiveness. Consider the overall user experience.

Consider Your Medication Needs

Factor in the frequency and cost of your prescriptions. Calculate the potential savings over a year based on your usage. This will help you determine if the plan’s annual cost is justified by potential savings.

Compare Total Cost

Don’t just focus on the discount percentage. Calculate the total cost including any enrollment fees, membership fees, and the discounted price of your medications. This provides a complete picture of the plan’s value.

Maximizing Savings with Your Prescription Drug Discount Plan

Compare prices across multiple pharmacies. Many discount plans work at various pharmacies, so check prices before filling your prescription. Websites and apps often provide this comparison service.

Generic Medications

Opt for generic drugs whenever possible. Generic medications are chemically equivalent to brand-name drugs but significantly cheaper. Your doctor can often recommend a suitable generic alternative.

Prescription Drug Savings Programs

Explore manufacturer coupons and patient assistance programs. Pharmaceutical companies frequently offer savings programs, sometimes reducing costs to near zero. Check their websites or ask your pharmacist for more information.

90-Day Supplies

Consider obtaining a 90-day supply instead of a 30-day supply. Although the upfront cost is higher, you’ll often receive a per-pill discount. This can substantially lower your annual medication expenses.

Negotiate Prices

Don’t hesitate to negotiate prices directly with your pharmacist, especially for high-cost medications. Explain your financial situation and explore potential discounts they might offer. Sometimes, a small reduction can make a difference.

Check for Hidden Fees

Review your prescription bill carefully. Hidden fees or processing charges can sometimes negate the savings offered by your discount plan. Clarify any unclear charges with the pharmacy.

Regularly Review Your Plan

Your needs and the drug market change. Periodically review your discount plan and compare it to alternative options. A different plan might better suit your current medication needs and budget.